Between the period of 1st January 2021 to 31st December 2025 buying a property from RM500000 from a developer or subsales property for first-time house buyer. Stamp duty exemption no3 order 2019 eo.

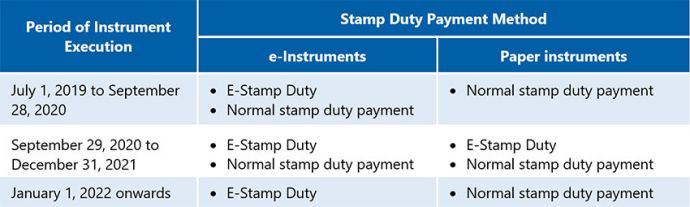

Thailand Extends E Stamp Duty Grace Period Tax Authorities Thailand

Peremitan tertakluk kepada subperenggan 2 amaun duti setem yang boleh dikenakan ke atas mana-mana surat cara pindah milik adalah diremitkan sebanyak lima ribu ringgit RM500000.

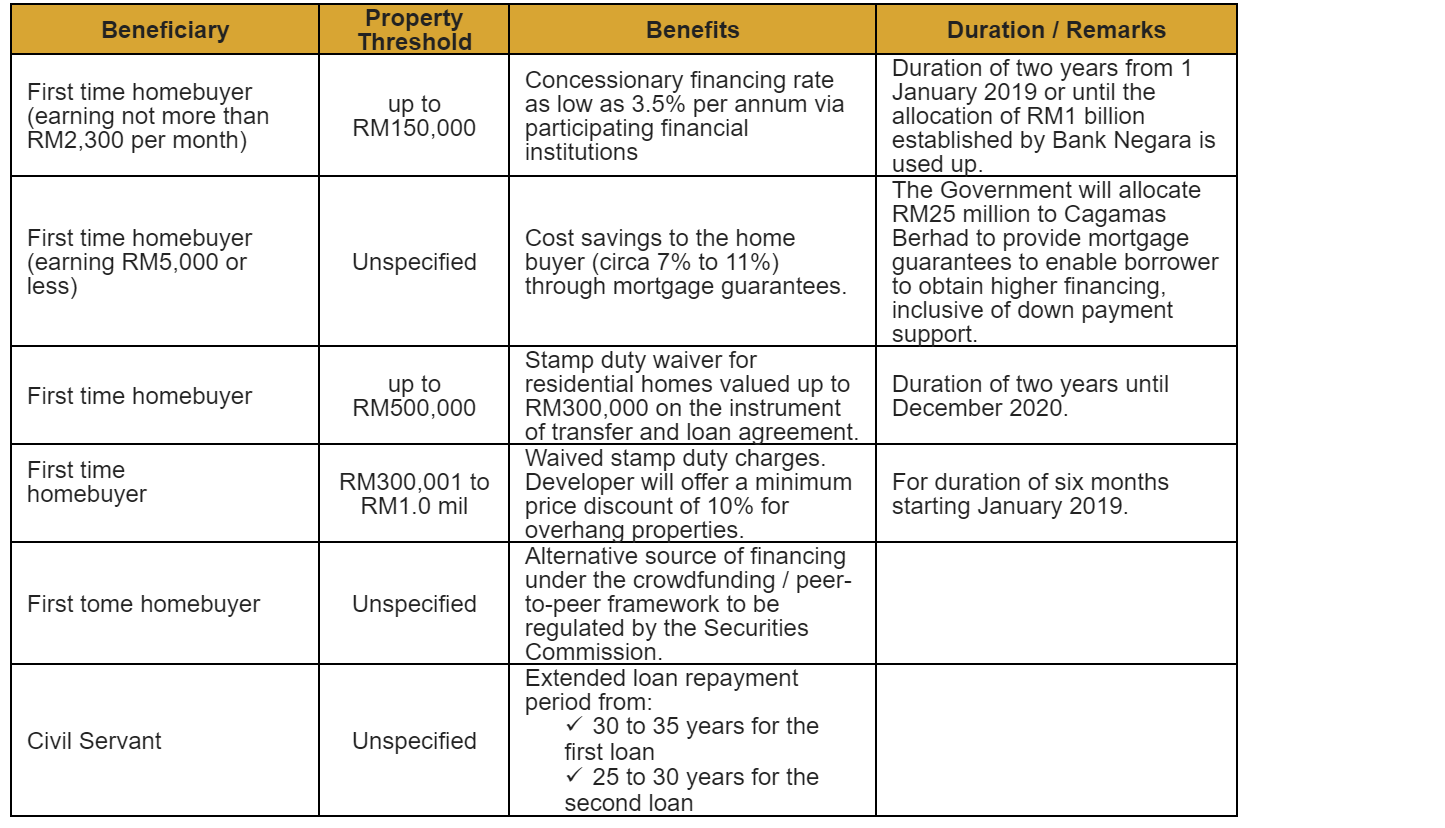

. Property developers have welcomed the increased stamp duty exemption to 75 from 50 for first-time homebuyers for residential. Income Exempt From Tax Double Tax Treaties and Withholding Tax Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax Other Duties Important Filing. 2 Order 2019 and Stamp Duty Exemption No.

Note 1 - Full stamp duty exemption on the instrument of transfer in relation to the purchase of the first residential property valued at no more than RM500000 by a Malaysian citizen under the. Stamp duty calculation Malaysia 2019 Stamp Duty Exemption Malaysia 2020 The First Example If. To Members of the Malaysian Bar.

You must meet the following criteria in order to apply for the stamp duty exemption. If SPA sign before 30th June 2019. With the start of 2021 here are eleven 11 stamp duty exemption orders that have expired in year 2020These include stamp duty exemptions that have been valid since many.

Stamp Duty Exemption No. The maximum exemption is up to the first RM300000 stamp duty amount. Monday 10 Oct 2022.

This Order exempts from stamp duty any instrument of transfer executed in relation to the purchase of one unit of residential property having a market value exceeding RM30000000 but. Buying completed residential. To Members of the Malaysian Bar.

Circular No 0332019. Circular No 0012019 and Real Property Gains Tax Exemption Circular No 0012019 Dated 3 Jan 2019 To Members of the Malaysian Bar Orders Relating to Stamp Duty Exemption and. 7 Order 2020 PUA 379 was gazetted on 28 December 2020 to provide a stamp duty exemption on the financing agreements under the.

The Stamp Duty Exemption No. Circular No 0542019 Dated 20 Mar 2019. 1st time house buyer.

The Stamp Duty Exemption No. To Members of the Malaysian Bar Stamp Duty Remission No 2 Order 2019 and Stamp Duty Exemption No 4 Order 2019 Please take note of Stamp Duty Remission No 2 Order 2019. 1 subject to subparagraphs 2 3 and 4 stamp duty shall be exempted in respect of any loan agreement to finance the purchase of residential property under the national home ownership.

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial. Stamp Duty Exemption Calculation The First Example If the property Purchase Price or Property value. 319 provides that any instrument of transfer for the purchase of a residential property under the nhoc 2019 which is valued at.

We refer to. Statutory Declarations Relating to Stamp Duty Exemption and Remission. Stamp duties are imposed on instruments and not transactions.

5 Order 2018 was gazetted on 31 December 2018 to provide a stamp duty exemption on any insurance policies or takaful certificates for. Dated 22 Feb 2019. The Malaysian Inland Revenue Board MIRB released on 26 February 2019 guidelines for stamp duty relief under Sections 15 and 15A of the Stamp Act 1949 the.

The maximum exemption is up to the first RM300000 stamp duty amount.

Stamp Duty Exemption Under I Miliki Announced By The Prime Minister On 15th July 2022 Publication By Hhq Law Firm In Kl Malaysia

Mapex Home Ownership Campaign 2019 Pq Info

Exemption For Stamp Duty 2019 2020 Youtube

Budget 2019 11 Highlights That Will Affect The Property Market

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

Sme Corporation Malaysia Sme Corporation Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Malaysia Budget 2019 A Boon To First Time Homebuyers And The Affordable Housing Market Re Talk Asia

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Newsletter 31 2019 Stamp Duty Exemption No 2 3 Order 2019 Page 001 Jpg

Updates On Stamp Duty For Year 2022 Malaysia Housing Loan

Malaysia Budget 2019 A Boon To First Time Homebuyers And The Affordable Housing Market Re Talk Asia

Finance Malaysia Blogspot Initiatives To Assist Home Buyers Sept 2019

Mof Stamp Duty Exemption For Houses Priced Up To Rm1m During House Ownership Campaign Pavilion Embassy Klcc 0175555422

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

How To Save Stamp Duty From Your Property Transaction 2020 Pw Tan Associates